BUSINESS

MyFastBroker.com: A Game-Changer for Modern Investors

itMyFastBroker.com is website designed to connect people and businesses with expert brokers in loans, business transactions, insurance, and mortgages. The site provides free access to valuation tools, market reports, and success stories to guide users in making informed decisions. In addition, MyFastBroker.com offers educational materials like tutorials, articles, and webinars to help users navigate the intricacies of financial markets and brokerage services. The website focuses on user-friendly design and accessibility, making it easier for users to find and connect with qualified brokers that suit their needs.

A Game-Changer for Modern Investors

It’s no surprise that the world of online trading has accelerated at a rapid pace due to technological advancements; thus, financial markets are more accessible than ever. Today, investors demand faster executions, better security, and effortless platforms with which both new and experienced traders can operate. MyFastBroker.com is one of these state-of-the-art tools that offer smooth trading with innovative features and an appealingly user-friendly interface to meet the modern investor’s needs.

MyFastBroker.com Overview

It is intuitive and very simple to navigate whether one is experienced or a rookie in trading. It has streamlined the otherwise technical trading processes and placed them within an easily traceable format from which one makes trades and identifies trends in markets with ease. Moreover, its access can be gained through the use of a desktop, tablet, or smartphone. It is highly customizable with the ability to change the dashboard, charts, and any of the other trading tools for best fitting with their particular strategy and personal taste.

Account Types and Features

To accommodate traders with varying experience levels and investment goals, MyFastBroker.com provides three account types:

- Basic Account: This is an ideal account for beginners. It offers essential trading features, standard market data, and a user-friendly interface for novice traders to begin their journey.

- Advanced Account: The advanced accounts include sophisticated trading tools, in-depth analysis, and priority customer support for investors.

- Professional Account: Tailored for professional traders, this account delivers premium features like algorithmic trading support, exclusive market insights, and personalized account management to enhance trading performance.

Range of Tradable Assets

MyFastBroker.com allows investors to access multiple financial markets, enabling them to choose better investment options. Traders can invest in stocks on major global exchanges and thereby gain exposure to some of the world’s most influential companies. The Forex market is available, incorporating a wide selection of currency pairs for any interested trader, from major to minor and even exotic pairs. In addition to this access, the commodity trading platform of MyFastBroker.com offers exposure to precious metals such as gold and silver, energy resources like oil and gas, and opportunities for those interested in the rapidly growing digital economy, supporting cryptocurrency trading, including popular assets like Bitcoin, Ethereum, and new digital currencies under development.

Trading Tools and Resources

MyFastBroker.com provides users with a suite of powerful tools and resources that enhance trading efficiency and facilitate better decision-making. Advanced charting tools and technical indicators help analyze the markets deeply and formulate effective strategies for trades. The site offers real-time market data analytics, allowing users to keep pace with price changes and trends occurring in the markets, ensuring appropriate decisions are made promptly. For those who seek automation, the platform supports automated and robot trading capabilities, allowing traders to execute strategies without constant manual intervention, maximizing opportunities even in volatile market conditions

Educational Materials

MyFastBroker.com will offer traders the tools and skills to successfully trade within the financial markets. The site has a rich selection of learning materials, which includes step-by-step guides, detailed webinars, and insightful articles that deal with many areas of trading. No matter if it’s a beginner eager to learn the basics or an experienced trader refining his advanced strategies, users will find the resources they need to advance their trading expertise. The platform also offers market analysis and expert insights on every important trend that may occur, due to any economic events, or strategic opportunities that allow traders to make informed decisions.

Security Measures

Security is of utmost importance at MyFastBroker.com, allowing users to trade with confidence. The website employs industry-standard encryption protocols to safeguard sensitive data and financial transactions from cyber threats. For added security, two-factor authentication (2FA) is implemented to prevent unauthorized access to accounts. MyFastBroker.com follows strict regulatory standards and maintains compliance with financial authorities to ensure the safety of user funds and a secure trading environment.

Competitive Advantages

MyFastBroker.com distinguishes itself by featuring a perfect fusion of modern technologies, user-focused features, and the aim for seamless trading processes. This one stands out since it features blindingly fast execution of trades, allowing its customers to grab those market opportunities. It allows a straightforward, highly adjustable interface, offering the user to get through an intuitive simplicity together with all its sophisticated features, thus serving for all the varying experience levels in traders. In comparison to other leading trading platforms, MyFastBroker.com excels in automation and AI-driven tools, where traders can use automated strategies and algorithmic trading with ease. In addition, the platform has strong educational resources and dedicated customer support, which makes it a favorite for both beginners and professionals seeking a well-rounded trading environment.

Potential drawbacks

While MyFastBroker.com offers many advantages, there are areas for improvement .Some users have reported that certain advanced features may have a learning curve, especially for beginners who are not familiar with algorithmic trading or complex charting tools. Furthermore, even though the platform supports a large number of assets, expanding the list of tradable cryptocurrencies and alternative investment options would further enhance its appeal. Addressing these challenges, the company is working aggressively on simplified onboarding tutorials and user-friendly AI assistants to enable a smoother way of accessing complex features by traders.

Future Developments

Looking ahead, MyFastBroker.com plans some exciting growth and innovation including expanded AI-driven trading insights, social trading capabilities that allow users to follow and replicate successful traders, and enhanced mobile app functionality for trading on the go.The company also continues to invest in blockchain-based security enhancements aimed at further enhancing user asset protection. These initiatives fit into the company’s strategic vision of accessible, intelligent, and secure trading that benefits all existing and potential users through ongoing and competitive changes.

Conclusion

MyFastBroker.com is , for sure, a trading facility for modern needs: fast trades, user-friendliness in an interface with an extensive line of assets consisting of stocks, forex, commodities, and crypto. It empowers both professionals and beginners who need powerful resource support to formulate better strategies—all of this made possible with advanced tools in charting, automated and real-time analytics in the marketplace. Solid safety measures, including encryption and two-factor authentication, maintain a secure trading environment. Others may have relatively advanced features but require a step-by-step adaptation process. Consistent updates, coupled with learning opportunities, help bridge those gaps. By continuously innovating with AI insights and social trading, MyFastBroker.com is currently one of the best options among traders who seek efficiency, reliability, and longevity in their activities.

BUSINESS

A&TA (Analysis & Targeted Action): A Strategic Approach

A&TA (Analysis & Targeted Action) is a purpose-built framework that helps organizations leverage data to design focused, results-oriented strategies. It guides decision-makers from raw data interpretation to hands-on execution, allowing them to solve problems efficiently and proactively. Whether optimizing internal operations or enhancing customer experience, A&TA creates a seamless link between analysis and action.

At the heart of A&TA is a fusion of data analytics, AI, and strategic planning. This article unpacks how the A&TA cycle works, explores its adaptability across industries, and underscores the role of AI in transforming strategy into measurable outcomes. A&TA isn’t just a framework — it’s the future of smart business execution.

Understanding A&TA: The Core Philosophy

As the proposal was, A&TA is a two-part approach:

- Analysis – The ordering examination of facts that seeks to identify tendencies, areas of ineffectiveness, prospects, and threats.

- Targeted Action – The use of those insights via effectiveness and results-oriented interventions that are meant to break through performance and results.

The A&TA Process: A Structured Pathway to Improvement

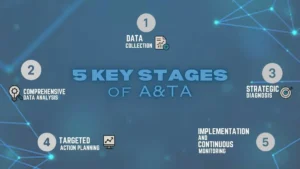

There is a well-defined iterative process that consists of five important steps:

1. Data Collection

A&TA is formulated on quality-relevant information. The first one involves establishing priorities on data to be collected under the business goals so that the content, quality, and accuracy of information are complete, timely, and intact.

2. Comprehensive Data Analysis

When useful data have been collected, they should be analyzed with useful tools and methods in order to reveal useful patterns, correlations, and outliers. During this stage, AI and machine learning could be vital. Moreover, AI-based analytics can display a real-time performance dashboard, thus providing decision-makers with real-time visibility into key metrics and trends that are valuable.

3. Strategic Diagnosis

The following stage of the A&TA framework is the diagnosis of why there occur any of the issues with performance or inefficiencies occur during the analysis stage. Through this, organizations can be able to focus on the most urgent matters that need urgent or high-impact actions.

4. Targeted Action Planning

According to the information obtained during the diagnosis phase, organizations come up with action plans in a procedural manner to suit the particular tasks. These action plans are formulated in SMART terms i.e. they are Specific, Measurable, Achievable, Relevant, and Time-bound, which makes them realistic and result-based.

5. Implementation and Continuous Monitoring

The last phase of A&TA is the implementation of the intended plans and constant monitoring of performance. Using orderly processes, with periodic reorganization, monitoring of KPIs in real-time, and periodic course corrections, helps in strengthening implementation.

Fostering a Culture of Continuous Improvement

A&TA is not a single operation strategy, but it is a process that has a loop system and allows more learning and growth at all levels of an organization. Analyzing performance data regularly, as well as putting action plans in line with the long-term objectives, will help businesses develop an environment where tracking improvements is a continuous process. This creates a culture of learning through feedback when the teams learn through each cycle, correct the course quickly, and slowly develop operational maturity. It makes employees more powerful as the work is based on openly shared data.

Role of AI in A&TA

In the era of big data, AI is indispensable to the A&TA framework. Here’s how AI contributes:

- Automated Data Processing: AI-powered algorithms can scan, filter, and process massive datasets in real-time, reducing human workload and errors.

- Predictive Analytics: Machine learning models can anticipate outcomes and trends, enabling proactive decisions.

- Natural Language Processing (NLP): AI tools can extract insights from unstructured text data, such as customer feedback or social media sentiment.

- Decision Support Systems: AI assists decision-makers with scenario planning, risk assessment, and impact forecasting.

Key Benefits

The adoption of A&TA provides several strategic and operational benefits:

- Enhanced Efficiency: Identifies inefficiencies and automates time-consuming tasks.

- Agility: Enables faster response to market changes and internal challenges.

- Improved ROI: Aligns actions with business goals, maximizing return on investment.

- Innovation: Uncovers hidden patterns and opportunities for innovation.

- Accountability: Data-backed action plans foster clear accountability across teams.

Combining A&TA with Other Methodologies

To maximize its results, A&TA may be integrated with other strategic approaches such as Lean, Six Sigma, Agile, or OKRs (Objectives & Key Results). Indicatively, Lean is centered on removing waste, and it becomes even more precise when combined with the analytical nature of A&TA. On the same note, Agile stresses the aspects of adaptability, which is in good relations with A&TAs iterative nature. Results-oriented OKRs complete the A&TA action-adventure implementation approach. The overlay of the methodologies of organizations allows them to develop a hybrid strategic model that is data-driven, outcome-oriented, and extremely flexible.

The Future

The path of development of A&TA is closely connected to the parallel development of AI. The triumvirate of these three concepts will help A&TA to work toward becoming more independent, more accurate in its predictive functions, and easily scalable. Our not-so-distant future will see AI bots already creating and activating certain courses of action in real-time based on the available data signals, and predictive analytics monitoring the possible problem, months before it occurs.

Conclusion

Analysis and Targeted Action are not just a methodology. They define an attitudinal change towards doing business purposes because of Data.

A world where rapid reactions, precision, and adaptability are the keys to success in business credits A&TA as a guiding star in leading the organization to achievable growth and sustainability in the long run. It is not a question of whether to adopt A&TA-but when can you start?

BUSINESS

Slayunny2: Fuel Your Passion, Share Your Voice

Slayunny2 is an opportunity to bring creativity, activism and dreams to the world and fire them up. Created to provide the cultural event for loneliness, it speaks the language of individual self-expression, being a very flexible service. Whether you are an artist promoting your work or an activist promoting a cause, this platform designed to offer all the required instruments and an active community to help with it. Unlike traditional social platforms, it prioritizes meaningful connections, fostering collaboration and engagement.

Core Features of Slayunny2

- Personalized Profiles: The users can further manage their accounts with personalized theme, layout and media features as per the user’s choice.

- Interactive Tools: Create Post useful contents like videos, polls, Collaborate project, for amateur and for a professional level You Tubers.

- Advanced Analytics: This approach measures the engagement and reach to provide real-time analytics for users and how to effectively manage their content and communications with others.

- Ease of Use: They are designed in a simple appearance that is easy to use while the features provided are quite strong to help any person to place content on them.

- Creativity and Collaboration: A large platform to display ones capabilities and to make friends or to get into ideas exchange on an international level.

Community Engagement

Community lies at the heart of Slayunny2, where users find like-minded individuals who share their passions and values. Unlike platforms that focus on superficial metrics, Slayunny2 prioritizes authentic interactions. It encourages the formation of communities around shared interests, be it art, activism, or innovation. Discussion forums, collaboration tools, and community events enhance engagement and connection. Users feel supported and inspired to contribute to a culture of mutual respect and creativity. By fostering genuine connections, it becomes a space where ideas flourish, and collaborations thrive, turning simple interactions into powerful relationships that transcend the digital real.

Creative Freedom on Slayunny2

Slaysunny2 is a haven for creativity, offering endless opportunities for users to explore and express their artistic talents. The platform’s diverse tools support everything from visual art to written narratives and multimedia projects. It allows creators to experiment without constraints, empowering them to push boundaries and redefine their work. Originality is celebrated, with features that highlight fresh content and provide visibility to unique voices. It ensures that creativity remains the focal point, offering resources that cater to diverse styles and ideas. Whether you’re showcasing a portfolio or exploring a new medium, Slayunny2 fuels your creative journey.

Empowering Voices

Slayunny2 is dedicated to amplifying underrepresented voices and creating space for meaningful conversations. The platform’s design ensures inclusivity, giving everyone a stage to share their stories and ideas. Activists and advocates find powerful tools to raise awareness and inspire action. Campaigns on it have addressed critical global issues, highlighting its potential for impact. I have realized that is not all about sharing the content—it is about initiating change and creating awareness. Slayunny2 bring in marginalized voices into the mainstream, addressing that all groups have the potential to positively impact society and drive change of any kind.

Collaborative Spaces

Collaboration is a defining feature of Slayunny2, where users come together to create, innovate, and inspire. The platform provides tools for joint projects, enabling individuals with shared goals to work seamlessly as a team. From creative ventures to advocacy campaigns, it makes it easy to brainstorm, plan, and execute ideas collaboratively The users are able to chat in the real time making their feedback and thereby co-develop projects that yield more results than when each person works on them independently. Relationships are encouraged, doors opened, and ideas are produced as a result of the keys to success, which is collaboration indeed best inspires creativity and innovative solutions.

Slayunny2 and Online Culture

Slayunny2 is reshaping the digital landscape by promoting genuine engagement and creativity over passive consumption. It sets trends by encouraging users to innovate and express themselves authentically. Unlike traditional platforms driven by algorithms and likes, it focuses on creating a culture of inclusivity and inspiration. It has become a space where communities thrive, creativity blossoms, and movements take root. The platform is influencing how people interact online, proving that digital spaces can foster meaningful connections and cultural evolution. As it continues to grow, its impact on online culture becomes increasingly evident, setting new standards for digital engagement.

Monetization Opportunities

For creators, Slayunny2 offers the chances to earn money on content and make passion their financial source. More like sponsorships, advertising opportunities, donations, or tips, the user has an option to turn a profit from their performance. Small businesses can also thrive on Slayunny2, using it as a space to showcase products or services and reach niche markets. By integrating monetization seamlessly into its ecosystem, it helps creators focus on doing what they love while earning. Whether you’re an aspiring entrepreneur or an established creator, it offers a supportive environment for financial growth and professional success.

Engagement Tools for Users

- Polls and Q&A Sessions: Encourage active participation and create interactive content that invites user engagement.

- Gamified Challenges: Add a fun and competitive element to boost interaction and make content more dynamic.

- Real-Time Analytics: Provide creators with insights on audience preferences to refine content and improve engagement strategies.

- Enhanced Interaction: Foster deeper connections between creators and their audience by promoting direct engagement and feedback.

- Community and Brand Growth: Help users grow their communities and build their brands through meaningful, measurable interactions.

Slayunny2 for Activists and Change-Makers

Slayunny2 is more than a platform—it’s a catalyst for impact. Campaign building tools, media content sharing as well as online communities for instance group discussion forums enable the activists to call for support and coordinate actions. Its emphasis on collaboration amplifies these efforts, allowing users to connect with others who share their goals. Whether it’s advocating for social justice, environmental sustainability, or any other cause, it provides a powerful space for creating movements and making a difference.

Conclusion

Slayunny2 is more than just a digital platform—it’s a vibrant community where creativity, connection, and collaboration thrive. By offering innovative tools and fostering an inclusive environment, it empowers users to share their passions, amplify their voices, and make a meaningful impact. Whether you’re an artist, activist, or entrepreneur, this platform provides the resources and support to turn your ideas into reality. Its commitment to authenticity, privacy, and accessibility sets it apart as a space where everyone is welcome. Join it today and become part of a movement that’s redefining online culture, inspiring change, and fueling passion worldwide

BUSINESS

Enhancing Operational Efficiency: The Role of Chemical Dosing Pumps in Modern Industries

Let’s be honest — when we think about the machines and tools that keep the world running, chemical dosing pumps aren’t exactly top of mind. They’re not shiny. They don’t have cool names. And they don’t get the attention that giant engines or robotic arms do.

But here’s the thing: chemical dosing pumps are kind of a big deal.

They might be small and quiet, but they’re doing some seriously important work behind the scenes, helping everything from water treatment plants to farms, food factories, and even breweries run safely, smoothly, and efficiently.

What is a chemical dosing pump?

Think of it like a super-precise little pump that adds just the right amount of chemicals to a system. Kind of like how you add salt “to taste” when cooking, except this is science, not spaghetti.

It could be adding chlorine to water, nutrients to crops, or cleaning agents to a food production line. The goal? Accuracy. Consistency. No mess, no waste, no surprises.

Because in industrial settings, too much or too little of anything (even something good) can cause major problems—contamination, equipment damage, regulatory violations, or just plain inefficiency.

So why does this matter?

1. They save money. A lot of money.

Overdosing chemicals is like pouring dollars down the drain—literally. These pumps make sure you’re using exactly what you need and not a drop more. No guesswork. No waste.

2. They keep things safe.

Whether it’s drinking water or a jar of pickles, the chemical levels have to be just right. Dosing pumps help hit those marks every single time, which keeps people safe and businesses compliant with regulations.

3. They just work.

Once they’re set up, they do their job quietly in the background. No drama. No constant tinkering. Just clean, consistent performance.

And the best part? With modern tech, many of today’s pumps are smart. We’re talking digital controls, remote monitoring, real-time alerts—like having a mini chemical engineer on call 24/7.

Companies like Blue-White are making some of the most advanced dosing pumps out there, with features that make them user-friendly and reliable.

Where are these pumps actually used?

Short answer: pretty much everywhere. But here are a few places where they shine:

- Water treatment facilities – They help make sure your tap water is clean and safe to drink. No over-chlorination, no weird tastes, no health hazards.

- Food & beverage production – Whether it’s sanitizing equipment or adding preservatives, dosing pumps keep things clean and consistent without ruining the flavor or breaking safety rules.

- Farms and greenhouses – Farmers use them to feed crops through irrigation systems (aka “fertigation”). The result? Healthier plants, less runoff, better harvests.

- Chemical manufacturing – In plants where precision is everything, these pumps help maintain balance and avoid costly mix-ups or dangerous chemical reactions.

The future of dosing: smarter, safer, better

If you’re picturing a basic little motor with a hose attached, think again. The new generation of chemical dosing pumps is seriously impressive.

Take Blue-White’s FLEXFLO® or CHEM-FEED® lines, for example. These pumps are built to handle tough environments, but they’re also packed with smart features—flow sensors, leak detection, even compatibility with SCADA systems. Translation: you always know what’s going on, and if something’s off, you’ll get a heads-up before it becomes a problem.

It’s all about giving teams more control, more insight, and way fewer headaches.

Bottom line? They’re underrated heroes.

Chemical dosing pumps won’t win any design awards. They’re not flashy or loud. But they are one of the most important tools for keeping modern industries efficient, clean, and safe.

They help save money, reduce waste, and make people’s jobs easier while quietly doing their job in the background. Kind of like a great teammate who doesn’t need the spotlight but shows up every day and gets the work done right.

So the next time you pour a glass of water, eat a salad, or turn on the tap without worrying about what’s coming out of it—just know there’s probably a chemical dosing pump working somewhere nearby, doing its job drop by drop.

And honestly? It deserves a little credit.

-

BIOGRAPHY1 month ago

BIOGRAPHY1 month agoBehind the Scenes with Sandra Orlow: An Exclusive Interview

-

HOME7 months ago

HOME7 months agoDiscovering Insights: A Deep Dive into the //vital-mag.net blog

-

HOME10 months ago

HOME10 months agoSifangds in Action: Real-Life Applications and Success Stories

-

BIOGRAPHY8 months ago

BIOGRAPHY8 months agoThe Woman Behind the Comedian: Meet Andrew Santino Wife